Which Of The Following Entry Modes Was Used Extensively In Globalization 1.0 Stage?

International-Expansion Entry Modes

Learning Objectives

After reading this section, students should be able to …

- draw the five common international-expansion entry modes.

- know the advantages and disadvantages of each entry manner.

- empathise the dynamics among the choice of dissimilar entry modes.

The Five Mutual International-Expansion Entry Modes

What is the best way to enter a new market? Should a company offset establish an export base or license its products to gain feel in a newly targeted state or region? Or does the potential associated with first-mover status justify a bolder move such as inbound an brotherhood, making an acquisition, or fifty-fifty starting a new subsidiary? Many companies move from exporting to licensing to a higher investment strategy, in issue treating these choices as a learning curve. Each has distinct advantages and disadvantages. In this section, nosotros will explore the traditional international-expansion entry modes. Across importing, international expansion is accomplished through exporting, licensing arrangements, partnering and strategic alliances, acquisitions, and establishing new, wholly owned subsidiaries, likewise known as greenfield ventures. These modes of entering international markets and their characteristics are shown in Tabular array 7.i "International-Expansion Entry Modes".1 Each manner of market entry has advantages and disadvantages. Firms need to evaluate their options to choose the entry fashion that all-time suits their strategy and goals.

Table vii.1 International-Expansion Entry Modes

| Type of Entry | Advantages | Disadvantages |

| Exporting | Fast entry, depression risk | Depression command, depression local knowledge, potential negative environmental impact of transportation |

| Licensing and Franchising | Fast entry, low cost, low risk | Less control, licensee may become a competitor, legal and regulatory environment (IP and contract law) must be sound |

| Partnering and Strategic Alliance | Shared costs reduce investment needed, reduced hazard, seen as local entity | Higher cost than exporting, licensing, or franchising; integration problems between ii corporate cultures |

| Acquisition | Fast entry; known, established operations | High cost, integration issues with home part |

| Greenfield Venture (Launch of a new, wholly owned subsidiary) | Proceeds local market knowledge; can be seen as insider who employs locals; maximum control | High cost, loftier take chances due to unknowns, slow entry due to setup fourth dimension |

Exporting

Exporting is the marketing and directly sale of domestically produced goods in another land. Exporting is a traditional and well-established method of reaching foreign markets. Since it does non crave that the appurtenances be produced in the target country, no investment in strange product facilities is required. Almost of the costs associated with exporting take the course of marketing expenses.

While relatively low risk, exporting entails substantial costs and limited command. Exporters typically have little control over the marketing and distribution of their products, face high transportation charges and possible tariffs, and must pay distributors for a variety of services. What is more, exporting does not give a company firsthand feel in staking out a competitive position abroad, and it makes it hard to customize products and services to local tastes and preferences.

Exporting is a typically the easiest mode to enter an international market, and therefore most firms begin their international expansion using this model of entry. Exporting is the sale of products and services in foreign countries that are sourced from the abode country. The advantage of this mode of entry is that firms avoid the expense of establishing operations in the new country. Firms must, however, accept a way to distribute and market place their products in the new country, which they typically exercise through contractual agreements with a local visitor or distributor. When exporting, the firm must give thought to labeling, packaging, and pricing the offering accordingly for the market. In terms of marketing and promotion, the firm will need to allow potential buyers know of its offerings, be information technology through advertising, trade shows, or a local sales force.

Amusing Anecdotes

1 common gene in exporting is the need to translate something about a production or service into the language of the target country. This requirement may be driven past local regulations or by the company's wish to market place the product or service in a locally friendly fashion. While this may seem to be a simple task, it'due south oftentimes a source of embarrassment for the visitor and sense of humour for competitors. David Ricks's book on international business blunders relates the following chestnut for U.s. companies doing business in the neighboring French-speaking Canadian province of Quebec. A company boasted oflait frais usage, which translates to "used fresh milk," when information technology meant to brag oflait frais employé, or "fresh milk used." The "terrific" pens sold past another company were instead promoted asterrifiantes, or terrifying. In another case, a company intending to say that its appliance could apply "any kind of electrical current," really stated that the appliance "wore out whatsoever kind of liquid." And imagine how one company felt when its product to "reduce heartburn" was advertised as i that reduced "the warmth of heart"!2

Among the disadvantages of exporting are the costs of transporting appurtenances to the country, which can be loftier and can take a negative impact on the environment. In improver, some countries impose tariffs on incoming goods, which will bear upon the firm's profits. In improver, firms that market and distribute products through a contractual understanding have less control over those operations and, naturally, must pay their distribution partner a fee for those services.

Ideals in Activeness

Companies are starting to consider the environmental impact of where they locate their manufacturing facilities. For example, Olam International, a cashew producer, originally shipped nuts grown in Africa to Asia for processing. Now, nonetheless, Olam has opened processing plants in Tanzania, Mozambique, and Nigeria. These locations are close to where the nuts are grown. The issue? Olam has lowered its processing and shipping costs by 25 percent while greatly reducing carbon emissions.3

As well, when Walmart enters a new market, it seeks to source produce for its nutrient sections from local farms that are most its warehouses. Walmart has learned that the savings it gets from lower transportation costs and the do good of being able to restock in smaller quantities more offset the lower prices information technology was getting from industrial farms located farther away. This practice is likewise a win-win for locals, who have the opportunity to sell to Walmart, which tin increase their profits and let them abound and hire more people and pay better wages. This, in turn, helps all the businesses in the local community.4

Firms export generally to countries that are close to their facilities because of the lower transportation costs and the ofttimes greater similarity between geographic neighbors. For instance, Mexico accounts for twoscore percent of the appurtenances exported from Texas.5 The Internet has also made exporting easier. Even modest firms can access critical information about strange markets, examine a target market place, research the competition, and create lists of potential customers. Even applying for export and import licenses is becoming easier as more governments use the Cyberspace to facilitate these processes.

Because the toll of exporting is lower than that of the other entry modes, entrepreneurs and small businesses are near probable to use exporting as a way to get their products into markets around the globe. Even with exporting, firms still confront the challenges of currency substitution rates. While larger firms have specialists that manage the exchange rates, small businesses rarely accept this expertise. Ane factor that has helped reduce the number of currencies that firms must deal with was the germination of the Eu (Eu) and the movement to a single currency, the euro, for the commencement time. As of 2011, seventeen of the twenty-seven EU members use the euro, giving businesses access to 331 1000000 people with that single currency.6

Licensing and Franchising

A company that wants to go into an international market speedily while taking only limited financial and legal risks might consider licensing agreements with foreign companies. An international licensing agreement allows a foreign company (thelicensee) to sell the products of a producer (thelicensor) or to use its intellectual property (such as patents, trademarks, copyrights) in exchange for royalty fees. Here's how it works: Y'all own a company in the Us that sells coffee-flavored popcorn. You lot're certain that your product would be a large hitting in Japan, but yous don't take the resources to set up a factory or sales function in that land. Yous can't make the popcorn hither and ship it to Nihon because it would get stale. So you lot enter into a licensing understanding with a Japanese visitor that allows your licensee to manufacture coffee-flavored popcorn using your special process and to sell information technology in Nihon under your brand name. In exchange, the Japanese licensee would pay you a royalty fee.

Licensing essentially permits a company in the target land to use the property of the licensor. Such property is ordinarily intangible, such every bit trademarks, patents, and product techniques. The licensee pays a fee in commutation for the rights to utilise the intangible property and possibly for technical assistance as well.

Because picayune investment on the part of the licensor is required, licensing has the potential to provide a very large return on investment. All the same, because the licensee produces and markets the product, potential returns from manufacturing and marketing activities may be lost. Thus, licensing reduces toll and involves limited take chances. However, it does not mitigate the substantial disadvantages associated with operating from a distance. Equally a rule, licensing strategies inhibit control and produce just moderate returns.

Another popular mode to aggrandize overseas is to sell franchises. Under an international franchise agreement, a company (thefranchiser) grants a foreign company (thefranchisee) the right to use its brand name and to sell its products or services. The franchisee is responsible for all operations but agrees to operate according to a business model established past the franchiser. In plough, the franchiser usually provides advertising, training, and new-product assist. Franchising is a natural form of global expansion for companies that operate domestically according to a franchise model, including restaurant chains, such every bit McDonald's and Kentucky Fried Craven, and hotel chains, such as Holiday Inn and Best Western.

Contract Manufacturing and Outsourcing

Because of loftier domestic labor costs, many U.S. companies industry their products in countries where labor costs are lower. This system is chosen international contract manufacturing or outsourcing. A U.S. visitor might contract with a local company in a foreign country to manufacture 1 of its products. It will, however, retain command of product blueprint and development and put its own label on the finished production. Contract manufacturing is quite common in the U.S. apparel business, with most American brands being made in a number of Asian countries, including China, Vietnam, Republic of indonesia, and Republic of india.[4]

Thanks to xx-first-century it, nonmanufacturing functions can also be outsourced to nations with lower labor costs. U.Due south. companies increasingly draw on a vast supply of relatively inexpensive skilled labor to perform diverse business services, such as software development, accounting, and claims processing. For years, American insurance companies have processed much of their claims-related paperwork in Ireland. With a big, well-educated population with English language linguistic communication skills, Republic of india has become a middle for software development and client-telephone call centers for American companies. In the instance of India, every bit you tin come across in Table 7.one "Selected Hourly Wages, United States and India" , the attraction is non only a large pool of knowledge workers but also significantly lower wages.

Table vii.one Selected Hourly Wages, United States and Bharat

| Occupation | U.S. Wage per 60 minutes (per year) | Indian Wage per Hour (per year) |

| Middle-level manager | $29.40 per hour ($60,000 per yr) | $6.thirty per 60 minutes ($13,000 per year) |

| It specialist | $35.10 per hour ($72,000 per year) | $7.fifty per hour ($15,000 per year) |

| Manual worker | $13.00 per hr ($27,000 per twelvemonth) | $2.twenty per hr ($5,000 per year) |

Source: Data obtained from "Huge Wage Gaps for the Same Work Between Countries – June 2011," WageIndicator.com, http://www.wageindicator.org/main/WageIndicatorgazette/wageindicator-news/huge-wage-gaps-for-the-same-work-between-countries-June-2011 (Links to an external site.)Links to an external site.(accessed September xx, 2011).

Partnerships and Strategic Alliances

Another way to enter a new market is through a strategic alliance with a local partner. A strategic alliance involves a contractual understanding between 2 or more enterprises stipulating that the involved parties will cooperate in a certain way for a certain time to achieve a common purpose. To decide if the alliance approach is suitable for the firm, the firm must make up one's mind what value the partner could bring to the venture in terms of both tangible and intangible aspects. The advantages of partnering with a local firm are that the local firm likely understands the local culture, market, and ways of doing business concern improve than an outside firm. Partners are especially valuable if they take a recognized, reputable brand proper name in the country or have existing relationships with customers that the firm might want to admission. For example, Cisco formed a strategic alliance with Fujitsu to develop routers for Japan. In the alliance, Cisco decided to co-brand with the Fujitsu proper noun and so that information technology could leverage Fujitsu's reputation in Japan for Information technology equipment and solutions while still retaining the Cisco proper noun to do good from Cisco's global reputation for switches and routers.seven Similarly, Xerox launched signed strategic alliances to abound sales in emerging markets such as Primal and Eastern Europe, India, and Brazil.viii

Strategic alliances and articulation ventures have go increasingly popular in contempo years. They allow companies to share the risks and resources required to enter international markets. And although returns also may have to be shared, they give a company a degree of flexibility non afforded by going information technology alone through direct investment.

At that place are several motivations for companies to consider a partnership as they expand globally, including (a) facilitating market place entry, (b) hazard and reward sharing, (c) technology sharing, (d) articulation product development, and (e) befitting to government regulations. Other benefits include political connections and distribution aqueduct access that may depend on relationships.

Such alliances often are favorable when (a) the partners' strategic goals converge while their competitive goals diverge; (b) the partners' size, market ability, and resources are minor compared to the manufacture leaders; and (c) partners are able to larn from one another while limiting access to their own proprietary skills.

What if a company wants to do business in a foreign country simply lacks the expertise or resources? Or what if the target nation's authorities doesn't allow foreign companies to operate within its borders unless it has a local partner? In these cases, a business firm might enter into a strategic alliance with a local company or even with the authorities itself. A strategic alliance is an understanding betwixt two companies (or a company and a nation) to puddle resources in social club to achieve business organization goals that benefit both partners. For example, Viacom (a leading global media company) has a strategic alliance with Beijing Television to produce Chinese-language music and entertainment programming.[five]

An alliance can serve a number of purposes:

- Enhancing marketing efforts

- Building sales and marketplace share

- Improving products

- Reducing production and distribution costs

- Sharing technology

Alliances range in telescopic from informal cooperative agreements to joint ventures—alliances in which the partners fund a carve up entity (perhaps a partnership or a corporation) to manage their joint operation. Mag publisher Hearst, for instance, has joint ventures with companies in several countries. And then, young women in Israel can readCosmo State of israel in Hebrew, and Russian women tin selection up a Russian-language version ofCosmo that meets their needs. The U.S. edition serves as a starting point to which nationally appropriate fabric is added in each unlike nation. This arroyo allows Hearst to sell the magazine in more than fifty countries.[six]

Strategic alliances are also advantageous for small entrepreneurial firms that may be besides small to make the needed investments to enter the new market themselves. In addition, some countries require foreign-endemic companies to partner with a local firm if they want to enter the market. For example, in Saudi Arabia, non-Saudi companies looking to practise business organisation in the country are required by law to take a Saudi partner. This requirement is mutual in many Eye Eastern countries. Even without this type of regulation, a local partner often helps foreign firms bridge the differences that otherwise brand doing business locally impossible. Walmart, for example, failed several times over most a decade to finer abound its business in Mexico, until it establish a stiff domestic partner with similar business organization values.

The disadvantages of partnering, on the other manus, are lack of direct control and the possibility that the partner'due south goals differ from the firm's goals. David Ricks, who has written a book on blunders in international business organization, describes the case of a US company eager to enter the Indian marketplace: "Information technology quickly negotiated terms and completed arrangements with its local partners. Certain required documents, however, such as the industrial license, foreign collaboration agreements, majuscule problems permit, import licenses for machinery and equipment, etc., were slow in being issued. Trying to expedite governmental approval of these items, the Us firm agreed to accept a lower royalty fee than originally stipulated. Despite all of this extra endeavour, the project was not greatly expedited, and the lower royalty fee reduced the firm'due south profit by approximately half a million dollars over the life of the agreement."9 Failing to consider the values or reliability of a potential partner can be costly, if not disastrous.

To avoid these missteps, Cisco created 1 globally integrated squad to oversee its alliances in emerging markets. Having a dedicated team allows Cisco to invest in grooming the managers how to manage the complex relationships involved in alliances. The team follows a consistent model, using and sharing all-time practices for the benefit of all its alliances.10

Did You Know?

Partnerships in emerging markets can be used for social good as well. For instance, pharmaceutical company Novartis crafted multiple partnerships with suppliers and manufacturers to develop, exam, and produce antimalaria medicine on a nonprofit basis. The partners included several Chinese suppliers and manufacturing partners too as a subcontract in Republic of kenya that grows the medication's key raw ingredient. To date, the partnership, chosen the Novartis Malaria Initiative, has saved an estimated 750,000 lives through the delivery of 300 meg doses of the medication.11

The key problems to consider in a joint venture are buying, control, length of understanding, pricing, applied science transfer, local firm capabilities and resources, and regime intentions. Potential problems include (a) disharmonize over disproportionate new investments, (b) mistrust over proprietary knowledge, (c) performance ambiguity, that is, how to "dissever the pie," (d) lack of parent firm support, (eastward) cultural clashes, and (f) if, how, and when to terminate the human relationship.

Ultimately, most companies will aim at building their own presence through company-owned facilities in important international markets.Acquisitions or greenfield start-ups represent this ultimate commitment. Acquisition is faster, but starting a new, wholly owned subsidiary might be the preferred option if no suitable acquisition candidates can exist institute.

Acquisitions

An acquisition is a transaction in which a firm gains control of another business firm past purchasing its stock, exchanging the stock for its ain, or, in the case of a private firm, paying the owners a purchase cost. In our increasingly flat world, cross-edge acquisitions have risen dramatically. In recent years, cross-border acquisitions have made up over 60 percent of all acquisitions completed worldwide. Acquisitions are appealing because they give the company quick, established access to a new market. However, they are expensive, which in the past had put them out of reach every bit a strategy for companies in the undeveloped world to pursue. What has inverse over the years is the forcefulness of different currencies. The higher interest rates in developing nations has strengthened their currencies relative to the dollar or euro. If the acquiring firm is in a country with a strong currency, the acquisition is comparatively cheaper to make. As Wharton professor Lawrence G. Hrebiniak explains, "Mergers fail because people pay besides much of a premium. If your currency is strong, yous can get a bargain."12

When deciding whether to pursue an acquisition strategy, firms examine the laws in the target state. Mainland china has many restrictions on foreign ownership, for example, simply even a developed-earth country similar the U.s. has laws addressing acquisitions. For case, you must be an American citizen to own a TV station in the United States. Likewise, a strange house is not allowed to own more than 25 percent of a U.s. airline.13

Acquisition is a good entry strategy to choose when scale is needed, which is peculiarly the instance in sure industries (e.g., wireless telecommunication). Acquisition is too a good strategy when an industry is consolidating. Even so, acquisitions are risky. Many studies have shown that betwixt 40 percentage and threescore percent of all acquisitions fail to increment the market value of the caused company by more than than the amount invested.14

Foreign Direct Investment and Subsidiaries

Many of the approaches to global expansion that we've discussed so far allow companies to participate in international markets without investing in foreign plants and facilities. Equally markets expand, withal, a firm might decide to enhance its competitive advantage by making a direct investment in operations conducted in some other country.

As well known equally foreign direct investment (FDI), acquisitions and greenfield start-ups involve the direct ownership of facilities in the target country and, therefore, the transfer of resources including upper-case letter, technology, and personnel. Directly buying provides a high caste of control in the operations and the ability to better know the consumers and competitive environs. However, it requires a loftier level of resources and a high degree of commitment.

Foreign direct investment refers to the formal institution of business operations on strange soil—the building of factories, sales offices, and distribution networks to serve local markets in a nation other than the visitor'southward home country. On the other hand offshoring occurs when the facilities prepare in the foreign state replace U.Southward. manufacturing facilities and are used to produce goods that volition exist sent back to the United States for auction. Shifting product to low-wage countries is frequently criticized as it results in the loss of jobs for U.S. workers.[7]

FDI is by and large the well-nigh expensive commitment that a firm tin can brand to an overseas market, and information technology'due south typically driven past the size and attractiveness of the target market. For example, German and Japanese automakers, such as BMW, Mercedes, Toyota, and Honda, take made serious commitments to the U.S. marketplace: nearly of the cars and trucks that they build in plants in the Southward and Midwest are destined for sale in the United states.

A mutual class of FDI is the strange subsidiary: an independent company owned by a foreign business firm (called theparent). This approach to going international not merely gives the parent company full access to local markets but as well exempts it from any laws or regulations that may hamper the activities of foreign firms. The parent company has tight control over the operations of a subsidiary, only while senior managers from the parent company often oversee operations, many managers and employees are citizens of the host land. Non surprisingly, most very large firms accept foreign subsidiaries. IBM and Coca-Cola, for example, have both had success in the Japanese market place through their foreign subsidiaries (IBM-Nihon and Coca-Cola–Japan). FDI goes in the other direction, also, and many companies operating in the U.s. are in fact subsidiaries of foreign firms. Gerber Products, for example, is a subsidiary of the Swiss visitor Novartis, while Stop & Store and Giant Food Stores belong to the Dutch visitor Purple Ahold.

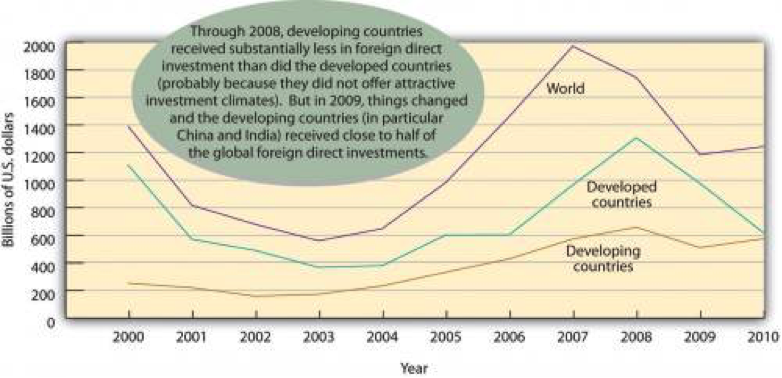

Where does most FDI upper-case letter finish upward? Figure 7.3 "Where FDI Goes" provides an overview of amounts, destinations (developed or developing countries), and trends.

Figure 7.iii Where FDI Goes

All these strategies have been successful in the arena of global business. But success in international business involves more than only finding the all-time way to reach international markets. Doing global business organization is a complex, risky endeavor. As many companies have learned the hard style, people and organizations don't exercise things the same manner away as they do at home. What differences brand global business and then tricky? That'south the question that nosotros'll plow to next.

Wholly Owned Subsidiaries

Firms may want to have a direct operating presence in the foreign country, completely under their control. To attain this, the company can establish a new, wholly endemic subsidiary (i.e., a greenfield venture) from scratch, or it can buy an existing company in that land. Some companies buy their resellers or early partners (as Vitrac Egypt did when it bought out the shares that its partner, Vitrac, endemic in the equity articulation venture). Other companies may buy a local supplier for direct control of the supply. This is known equally vertical integration.

Establishing or purchasing a wholly owned subsidiary requires the highest commitment on the part of the international house, because the house must assume all of the take a chance—financial, currency, economic, and political.

The process of establishing of a new, wholly owned subsidiary is often complex and potentially costly, but it affords the house maximum control and has the near potential to provide to a higher place-average returns. The costs and risks are high given the costs of establishing a new business operation in a new land. The firm may accept to acquire the noesis and expertise of the existing market place by hiring either host-land nationals—mayhap from competitive firms—or costly consultants. An advantage is that the business firm retains command of all its operations.

Did Y'all Know: McDonald'due south International

McDonald'southward has a plant in Italy that supplies all the buns for McDonald'south restaurants in Italia, Greece, and Malta. International sales has deemed for as much as sixty percent of McDonald's annual revenue.15

Cautions When Purchasing an Existing Foreign Enterprise

Every bit nosotros've seen, some companies opt to purchase an existing company in the foreign state outright as a way to get into a strange market quickly. When making an conquering, due diligence is important—not just on the financial side just too on the side of the state's culture and business organization practices. The annual disposable income in Russia, for case, exceeds that of all the other BRIC countries (i.e., Brazil, Bharat, and China). For many major companies, Russia is too big and also rich to ignore as a market. Even so, Russian federation too has a reputation for abuse and red tape that even its highest-ranking officials admit. In aBusinessWeek article, presidential economic counselor Arkady Dvorkovich (whose office in the Kremlin was one time occupied by Soviet leader Leonid Brezhnev), for example, advises, "Investors should cull wisely" which regions of Russia they locate their business organization in, alert that some areas are more than decadent than others. Corruption makes the globe less flat precisely because information technology undermines the viability of legal vehicles, such as licensing, which otherwise lead to a flatter earth.

The civilization of corruption is even embedded into some Russian company structures. In the 1990s, laws inadvertently encouraged Russian firms to establish legal headquarters in offshore tax havens, similar Cyprus. A tax haven is a country that has very advantageous (low) corporate income taxes.

Businesses registered in these offshore revenue enhancement havens to avoid certain Russian taxes. Even though companies could obtain a refund on these taxes from the Russian regime, "the process is and then complicated you lot never actually become a refund," said Andrey Pozdnyakov, cofounder of Siberian-based Elecard, in the aforementionedBusinessWeek article.

This offshore registration, unfortunately, is a danger sign to potential investors like Intel. "We tin't invest in companies that have even a slight shadow," said Intel'south Moscow-based regional managing director Dmitry Konash about the circuitous structure predicament. 16

Did You lot Know: Business concern Collaborations in Prc

Some strange companies believe that owning their own operations in People's republic of china is an easier option than having to deal with a Chinese partner. For example, many strange companies nevertheless fear that their Chinese partners will learn too much from them and become competitors. Nonetheless, in nigh cases, the Chinese partner knows the local civilization—both that of the customers and workers—and is improve equipped to deal with Chinese bureaucracy and regulations. In addition, even wholly owned subsidiaries can't be totally contained of Chinese firms, on whom they might accept to rely for raw materials and shipping as well every bit maintenance of authorities contracts and distribution channels.

Collaborations offer dissimilar kinds of opportunities and challenges than cocky-handling Chinese operations. For most companies, the local nuances of the Chinese marketplace make some form of collaboration desirable. The companies that opt to self-handle their Chinese operations tend to be very large and/or accept a proprietary technology base of operations, such every bit high-tech or aerospace companies—for example, Boeing or Microsoft. Even and then, these companies tend to hire senior Chinese managers and consultants to facilitate their market entry and then assist manage their expansion. Nevertheless, navigating the local Chinese bureaucracy is tough, even for the most-experienced companies.

Permit'due south take a deeper wait at i company'due south entry path and its wholly owned subsidiary in Mainland china. Embraer is the largest aircraft maker in Brazil and i of the largest in the earth. Embraer chose to enter Cathay as its first foreign market, using the joint-venture entry mode. In 2003, Embraer and the Aviation Industry Corporation of China jointly started the Harbin Embraer Shipping Industry. A year afterward, Harbin Embraer began manufacturing aircraft.

In 2010, Embraer announced the opening of its offset subsidiary in China. The subsidiary, chosen Embraer Prc Aircraft Technical Services Co. Ltd., will provide logistics and spare-parts sales, likewise as consulting services regarding technical issues and flight operations, for Embraer shipping in China (both for existing aircraft and those on order). Embraer volition invest $18 million into the subsidiary with a goal of strengthening its local customer support, given the steady growth of its business in China.

Guan Dongyuan, president of Embraer China and CEO of the subsidiary, said the establishment of Embraer Mainland china Aircraft Technical Services demonstrates the company'due south "long-term delivery and conviction in the growing Chinese aviation market."17

Building Long-Term Relationships

Developing a proficient relationship with regulators in target countries helps with the long-term entry strategy. Building these relationships may include keeping people in the countries long enough to form good ties, since a deal negotiated with one person may autumn apart if that person returns too quickly to headquarters.

Did You Know: Guanxi

Ane of the most important cultural factors in China isguanxi (pronouncedguan shi), which is loosely defined as a connexion based on reciprocity. Even when just coming together a new company or potential partner, it'southward best to have an introduction from a mutual business concern partner, vendor, or supplier—someone the Chinese will respect. China is a relationship-based order. Relationships extend well beyond the personal side and tin can drive concern also. With guanxi, a person invests with relationships much similar ane would invest with uppercase. In a sense, it'south alike to the Western phrase "You owe me i."

Guanxi can potentially exist benign or harmful. At its best, it can assist foster strong, harmonious relationships with corporate and authorities contacts. At its worst, it tin can encourage bribery and corruption. Whatever the instance, companies without guanxi won't accomplish much in the Chinese market place. Many companies address this need by entering into the Chinese market in a collaborative organization with a local Chinese visitor. This entry option has also been a useful way to circumvent regulations governing bribery and abuse, but it can enhance upstanding questions, especially for American and Western companies that have a unlike cultural perspective on gift giving and bribery.

Mini Case: Coca-Cola and Illy Caffé18

In March 2008, the Coca-Cola company and Illy Caffé Spa finalized a joint venture and launched a premium ready-to-drink espresso-based coffee drink. The joint venture, Ilko Coffee International, was created to bring three set-to-drinkable coffee products—Caffè, an Italian chilled espresso-based coffee; Cappuccino, an intense espresso, blended with milk and dark cacao; and Latte Macchiato, a polish espresso, swirled with milk—to consumers in 10 European countries. The products volition be bachelor in fashionable, premium cans (150 ml for Caffè and 200 ml for the milk variants). All 3 offerings will be available in 10 European Coca-Cola Hellenic markets including Austria, Croatia, Hellenic republic, and Ukraine. Boosted countries in Europe, Asia, North America, Eurasia, and the Pacific were slated for expansion into 2009.

The Coca-Cola Visitor is the world's largest potable company. Along with Coca-Cola, recognized equally the globe's nearly valuable brand, the company markets four of the world'southward elevation five nonalcoholic sparkling brands, including Diet Coke, Fanta, Sprite, and a wide range of other beverages, including nutrition and light beverages, waters, juices and juice drinks, teas, coffees, and energy and sports drinks. Through the earth's largest drinkable distribution organisation, consumers in more than than 200 countries enjoy the company's beverages at a rate of one.5 billion servings each twenty-four hour period.

Based in Trieste, Italia, Illy Caffé produces and markets a unique blend of espresso coffee nether a single brand leader in quality. Over 6 million cups of Illy espresso java are enjoyed every solar day. Illy is sold in over 140 countries around the world and is available in more than fifty,000 of the best restaurants and coffee confined. Illy buys greenish coffee directly from the growers of the highest quality Arabica through partnerships based on the mutual creation of value. The Trieste-based company fosters long-term collaborations with the earth'due south best coffee growers—in Brazil, Fundamental America, India, and Africa—providing know-how and technology and offering above-market prices.

In summary, when deciding which manner of entry to choose, companies should enquire themselves two key questions:

- How much of our resources are we willing to commit? The fewer the resource (i.e., money, time, and expertise) the company wants (or can afford) to devote, the better it is for the company to enter the strange market on a contractual basis—through licensing, franchising, direction contracts, or turnkey projects.

- How much control do we wish to retain? The more control a company wants, the amend off information technology is establishing or buying a wholly owned subsidiary or, at least, entering via a joint venture with advisedly delineated responsibilities and accountabilities between the partner companies.

Regardless of which entry strategy a company chooses, several factors are always important.

- Cultural and linguistic differences. These touch all relationships and interactions within the company, with customers, and with the regime. Agreement the local concern culture is critical to success.

- Quality and training of local contacts and/or employees. Evaluating skill sets and so determining if the local staff is qualified is a key gene for success.

- Political and economical issues. Policy can modify often, and companies need to determine what level of investment they're willing to brand, what'south required to make this investment, and how much of their earnings they can repatriate.

- Feel of the partner company. Assessing the experience of the partner company in the marketplace—with the product and in dealing with strange companies—is essential in selecting the right local partner.

Companies seeking to enter a foreign market need to practice the following:

- Research the strange market thoroughly and acquire about the state and its culture.

- Empathize the unique business and regulatory relationships that impact their industry.

- Use the Internet to identify and communicate with advisable foreign trade corporations in the country or with their own government'south embassy in that land. Each embassy has its own trade and commercial desk. For example, the U.s. Embassy has a foreign commercial desk-bound with officers who help Us companies on how best to enter the local market. These resource are best for smaller companies. Larger companies, with more money and resources, usually hire acme consultants to practice this for them. They're likewise able to have a dedicated team assigned to the strange country that can travel the country frequently for the later on-phase entry strategies that involve investment.

In one case a company has decided to enter the foreign market place, information technology needs to spend some fourth dimension learning nigh the local business culture and how to operate within it.

Entrepreneurship and Strategy

The Chinese have a "Why non me?" attitude. As Edward Tse, author ofThe Prc Strategy: Harnessing the Power of the World'southward Fastest-Growing Economic system, explains, this means that "in all corners of China, there will be people asking, 'If Li Ka-shing [the chairman of Cheung Kong Holdings] can be then wealthy, if Bill Gates or Warren Buffett can exist so successful, why non me?' This cuts across Communist china'due south demographic profiles: from people in big cities to people in smaller cities or rural areas, from older to younger people. There is a huge dynamism among them."nineteen Tse sees entrepreneurial Communist china as "entrepreneurial people at the grassroots level who are very contained-minded. They're very quick on their feet. They're prone to fearless experimentation: imitating other companies hither and there, trying new ideas, and then, if they neglect, rapidly adapting and moving on." As a event, he sees Red china condign not only a very large consumer market but besides a strong innovator. Therefore, he advises US firms to enter China sooner rather than later so that they tin can take advantage of the opportunities there. Tse says, "Companies are coming to realize that they need to integrate more than and more of their value chains into People's republic of china and Republic of india. They demand to be shut to these markets, because of their size. They demand the ability to understand the needs of their customers in emerging markets, and turn them into production and service offerings quickly."xx

REFERENCES

- [1]Fine Waters Media, "Bottled Water of France," http://www.finewaters.com/Bottled_Water/French republic/Evian.asp (Links to an external site.)Links to an external site. (accessed May 25, 2006).

- [2]H. Frederick Gale, "China'southward Growing Affluence: How Food Markets Are Responding" (U.South. Department of Agriculture, June 2003), http://www.ers.usda.gov/Amberwaves/June03/Features/ChinasGrowingAffluence.htm (Links to an external site.)Links to an external site. (accessed May 25, 2006).

- [3]American Soybean Association, "ASA Testifies on Importance of People's republic of china Market place to U.Due south. Soybean Exports," June 22, 2010, http://www.soygrowers.com/newsroom/releases/2010_releases/r062210.htm (Links to an external site.)Links to an external site. (accessed August 21, 2011).

- [4]Gary Gereffi and Stacey Frederick, "The Global Apparel Value Chain, Merchandise and the Crisis: Challenges and Opportunities for Developing Countries," The Globe Banking concern, Evolution Research Group, Merchandise and Integration Squad, April 2010, http://www.iadb.org/intal/intalcdi/PE/2010/05413.pdf (Links to an external site.)Links to an external site. (accessed August 21, 2011).

- [5]Viacom International, "Viacom Announces a Strategic Alliance for Chinese Content Production with Beijing Telly (BTV)," Oct 16, 2004, http://www.viacom.com/press.can?ixPressRelease=80454169 (Links to an external site.)Links to an external site..

- [6]Liz Borod, "DA! To the Skilful Life,"Folio, September ane, 2004, http://www.keepmedia.com/pubs/Folio/2004/09/01/574543?ba=grand&bi=1&bp=7 (Links to an external site.)Links to an external site. (accessed May 25, 2006); Jill Garbi, "Cosmo Girl Goes to State of israel,"Folio, November 1, 2003, http://world wide web.keepmedia.com/pubs/Page/2003/11/01/293597?ba=thousand&bi=0&bp=seven (Links to an external site.)Links to an external site. (accessed May 25, 2006); Liz Borod, "A Passage to India,"Folio, August 1, 2004, http://www.keepmedia.com/pubs/Forbes/2000/10/30/1017010?ba=a&bi=ane&bp=7 (Links to an external site.)Links to an external site. (accessed May 25, 2006); Jill Garbi, "A Sleeping Media Behemothic?"Folio, January 1, 2004, http://www.keepmedia.com/pubs/Folio/2004/01/01/340826?ba=chiliad&bi=0&bp=7 (Links to an external site.)Links to an external site. (accessed May 25, 2006).

- [7]Michael Mandel, "The Existent Cost of Offshoring,"Bloomberg BusinessWeek, June 28, 2007, http://www.businessweek.com/magazine/content/07_25/b4039001.htm (Links to an external site.)Links to an external site., (accessed August 21, 2011).

- [eight]"Global 500,"Fortune (CNNMoney), http://money.cnn.com/magazines/fortune/global500/2010/full_list/ (Links to an external site.)Links to an external site. (accessed August 21, 2011).

- [9]James C. Morgan and J. Jeffrey Morgan,Bully the Japanese Market place (New York: Free Press, 1991), 102.

- [10]"Glocalization Examples—Think Globally and Deed Locally," CaseStudyInc.com, http://www.casestudyinc.com/glocalization-examples-think-globally-and-human action-locally (Links to an external site.)Links to an external site. (accessed August 21, 2011).

- [xi]McDonald'south Republic of india, "Respect for Local Culture," http://www.mcdonaldsindia.com/loccul.htm (Links to an external site.)Links to an external site. (accessed May 25, 2006).

- [12]McDonald'south Corp., "A Sense of taste of McDonald's Around the World,"media.mcdonalds.com, http://www.media.mcdonalds.com/secured/products/international (Links to an external site.)Links to an external site. (accessed May 25, 2006).

- [xiii]"Glocalization Examples—Think Globally and Act Locally," CaseStudyInc.com, http://www.casestudyinc.com/glocalization-examples-think-globally-and-act-locally (Links to an external site.)Links to an external site. (accessed Baronial 21, 2011).

- [xiv]James C. Morgan and J. Jeffrey Morgan,Cracking the Japanese Market place (New York: Free Press, 1991), 117.

- [fifteen]Anne O. Krueger, "Supporting Globalization" (remarks, 2002 Eisenhower National Security Conference on "National Security for the 21st Century: Anticipating Challenges, Seizing Opportunities, Building Capabilities," September 26, 2002), http://www.imf.org/external/np/speeches/2002/092602a.htm (Links to an external site.)Links to an external site. (accessed May 25, 2006).

1. Shaker A. Zahra, R. Duane Ireland, and Michael A. Hitt, "International Expansion by New Venture Firms: International Diverseness, Style of Market Entry, Technological Learning, and Operation," Academy of Management Journal 43, no. 5 (October 2000): 925–50.

2. David A. Ricks, Blunders in International Business (Hoboken, NJ: Wiley-Blackwell, 1999), 101.

3. Michael Eastward. Porter and Mark R. Kramer, "The Large Thought: Creating Shared Value," Harvard Business organization Review , January–February 2011, accessed January 23, 2011, http://hbr.org/2011/01/the-big-idea-creating-shared-value/ar/pr.

4. Michael E. Porter and Marker R. Kramer, "The Big Idea: Creating Shared Value," Harvard Business Review , January–February 2011, accessed January 23, 2011, http://hbr.org/2011/01/the-large-idea-creating-shared-value/ar/pr.

5. Andrew J. Cassey, "Analyzing the Export Menstruum from Texas to United mexican states," StaffPAPERS: Federal Reserve Banking company of Dallas , No. 11, Oct 2010, accessed February fourteen, 2011, http://world wide web.dallasfed.org/research/staff/2010/staff1003.pdf.

6. "The Euro," European Commission, accessed Feb eleven, 2011, http://ec.europa.eu/euro/index_en.html.

7. Steve Steinhilber, Strategic Alliances (Cambridge, MA: Harvard Business School Printing, 2008), 113.

viii. "ASAP Releases Winners of 2010 Alliance Excellence Awards," Clan for Strategic Brotherhood Professionals, September 2, 2010, accessed Feb 12, 2011, http://newslife.us/technology/mobile/ASAP-Releases-Winners-of-2010-Alliance-Excellence-Awards.

ix. David A. Ricks, Blunders in International Concern (Hoboken, NJ: Wiley-Blackwell, 1999), 101.

10. Steve Steinhilber, Strategic Alliances (Cambridge, MA: Harvard Business School Press, 2008), 125.

11. "ASAP Releases Winners of 2010 Alliance Excellence Awards," Association for Strategic Alliance Professionals, September ii, 2010, accessed September 20, 2010, http://newslife.us/applied science/mobile/ASAP-Releases-Winners-of-2010-Alliance-Excellence-Awards.

12. "Playing on a Global Stage: Asian Firms See a New Strategy in Acquisitions Abroad and at Dwelling," Cognition@Wharton, Apr 28, 2010, accessed January 15, 2011, http://cognition.wharton.upenn.edu/article.cfm?articleid=2473.

13. "Playing on a Global Stage: Asian Firms See a New Strategy in Acquisitions Abroad and at Home," Knowledge@Wharton, April 28, 2010, accessed January xv, 2011, http://knowledge.wharton.upenn.edu/article.cfm?articleid=2473.

14. "Playing on a Global Stage: Asian Firms Come across a New Strategy in Acquisitions Away and at Dwelling house," Noesis@Wharton , April 28, 2010, accessed January fifteen, 2011, http://knowledge.wharton.upenn.edu/commodity.cfm?articleid=2473.

xv. Annual revenue in 2008 was $23.v billion, of which 60 percent was international. Source: Suzanne Kapner, "Making Dough," Fortune, Baronial 17, 2009, 14.

16. Source: Carol Matlack, "The Peril and Hope of Investing in Russian federation," BusinessWeek, October v, 2009, 48–51.

17. Source: United Press International, "Brazil's Embraer Expands Aircraft Business organization into Cathay," July 7, 2010, accessed August 27, 2010, http://www.upi.com/Business_News/2010/07/07/Brazils-Embraer-expands-aircraft-business-into-Mainland china/UPI-10511278532701.

18. http://www.thecoca-colacompany.com/; http://www.illy.com/

19. Art Kleiner, "Getting China Right," Strategy and Business , March 22, 2010, accessed January 23, 2011, http://world wide web.strategy-concern.com/article/00026?pg=al.

20. Art Kleiner, "Getting Communist china Right," Strategy and Business, March 22, 2010, accessed Jan 23, 2011, http://www.strategy-business.com/article/00026?pg=al.

This page is licensed under a Creative Commons Attribution Non-Commercial Share-Akin License (Links to an external site) Links to an external site and contains content from a multifariousness of sources published nether a variety of open up licenses, including:

-

Original content contributed by Lumen Learning

-

Content(Links to an external site.)Links to an external site. created past Anonymous under a Creative Commons Attribution Not-Commercial Share-Alike License (Links to an external site.)Links to an external site.

-

International Business.Authored by: bearding.Provided by: Lardbucket.Located at:License: CC BY-NC-SA: Attribution-NonCommercial-ShareAlike

-

International Business organization v. i.0' published by Saylor University, the creator or licensor of this work.

-

"Entry Strategies: Modes of Entry", section 5.3 from the book Global Strategy (v. 1.0) nether a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 License without attribution every bit requested by the work'south original creator or licensor.

-

'Fundamentals of Global Strategy v. 1.0' under a Artistic Commons Attribution-NonCommercial-ShareAlike iii.0 License without attribution as requested past the work's original creator or licensor.

-

Image of Embraer190.Authored by: Antonio Milena.Located at:http://en.wikipedia.org/wiki/Embraer#mediaviewer/File:Embraer_190.jpg.License: CC Past: Attribution

I would like to give thanks Andy Schmitz for his work in maintaining and improving the HTML versions of these textbooks. This textbook is adjusted from his HTML version, and his projection can be found hither.

Source: https://opentext.wsu.edu/cpim/chapter/7-1-international-entry-modes/

Posted by: thortonshouressunt80.blogspot.com

0 Response to "Which Of The Following Entry Modes Was Used Extensively In Globalization 1.0 Stage?"

Post a Comment